Customer lifetime value (LTV) is an important measure of unit economics for MedTech and HealthTech companies. LTV is a measure of your product or service offering’s profitability over a length of 3 to 5 years. Since the LTV is calculated over a time period, the profits are discounted to come to a net present value for each additional customer. Note that LTV does not take into account the costs associated with acquiring a customer (CAC), which is an important consideration that helps determine your sales and marketing expense.

The first step to determining your LTV is to decide on your business model. Do you plan to sell your product or service offering as a one-time fee? Do you have a razor-blade model where you sell a device with ongoing consumables? Will you have a subscription and ongoing service? Or maybe you have some combination all of the above? There are many business models to choose from and your choice will depend on your product or service offering and the core strengths of your team. Your choice of business model will also have an important effect on your LTV calculations.

Once you have decided on your business model, calculating the LTV requires a few key pieces of information:

1. Your product pricing and revenue streams: What is the price of your product? How much product do you expect your average customer to buy? Is there a one-time revenue stream, a recurring revenue stream or both? Do you have any upselling opportunities once you have landed a customer that do not require much work on behalf of the sales and marketing team?

2. Product repurchase rate: For one-time revenue streams, how frequently you think your customers will be repurchasing your product over a 3 to 5 year window?

3. Your customer retention rate: For recurring revenue streams, what percentage of customers will continue paying a recurring fee for use of the product or service?

4. Your cost of goods sold (COGS): How much does it take to produce or make each of your individual products? Note that this does not include costs associated with sales & marketing, R&D or administration.

5. Weighted average cost of capital (WACC): The WACC an estimate of how much of a premium investors place on investing today in your solution. The number is highly variable, but generally somewhere between 35 and 75 percent depending on the offering, financial markets and experience on the team. A high WACC means that revenues in later years become less important and this is one of the reasons you typically don’t see LTV calculations go beyond 5 years.

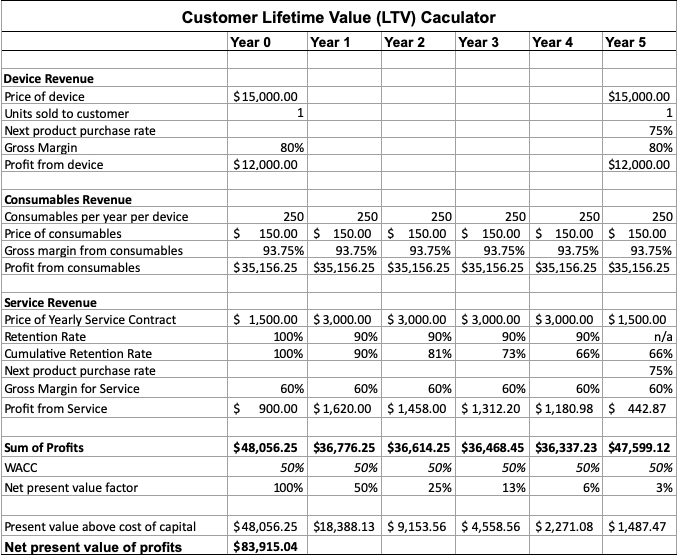

A simple spreadsheet can help you easily calculate your LTV once you have all of the above information. I have included a simple template based on a widget that you can use for LTV calculations here. The widget has a one-time revenue stream upon purchase, a recurring revenue stream for consumables, and a service upsell included in the calculations.

A positive LTV means that you are contributing to your gross profit with each additional customer. A negative LTV means that your unit economics aren’t sustainable and you may need to reconsider your offering’s value proposition, pricing, or business model. It could also mean that your offering is not profitable at lower volumes, however, at higher volumes your offering becomes profitable.

Whatever the case, LTV is an important metric to help understand your business’ unit economics and will be a key consideration for potential investors and savvy board members.